“`json{ “seo_title”: “Trump’s 2025 AI Chip Policy Shift: Impact on Global Tech and U.S. Competitiveness”, “content”: “

Table of Contents

- Introduction

- Understanding the Three-Tier System

- The New Approach Taking Shape

- Market Reaction and Industry Impact

- Global Winners and Losers

- Uncertainty Ahead

- Balancing Competing Priorities

- Key Takeaways

- FAQ

Introduction

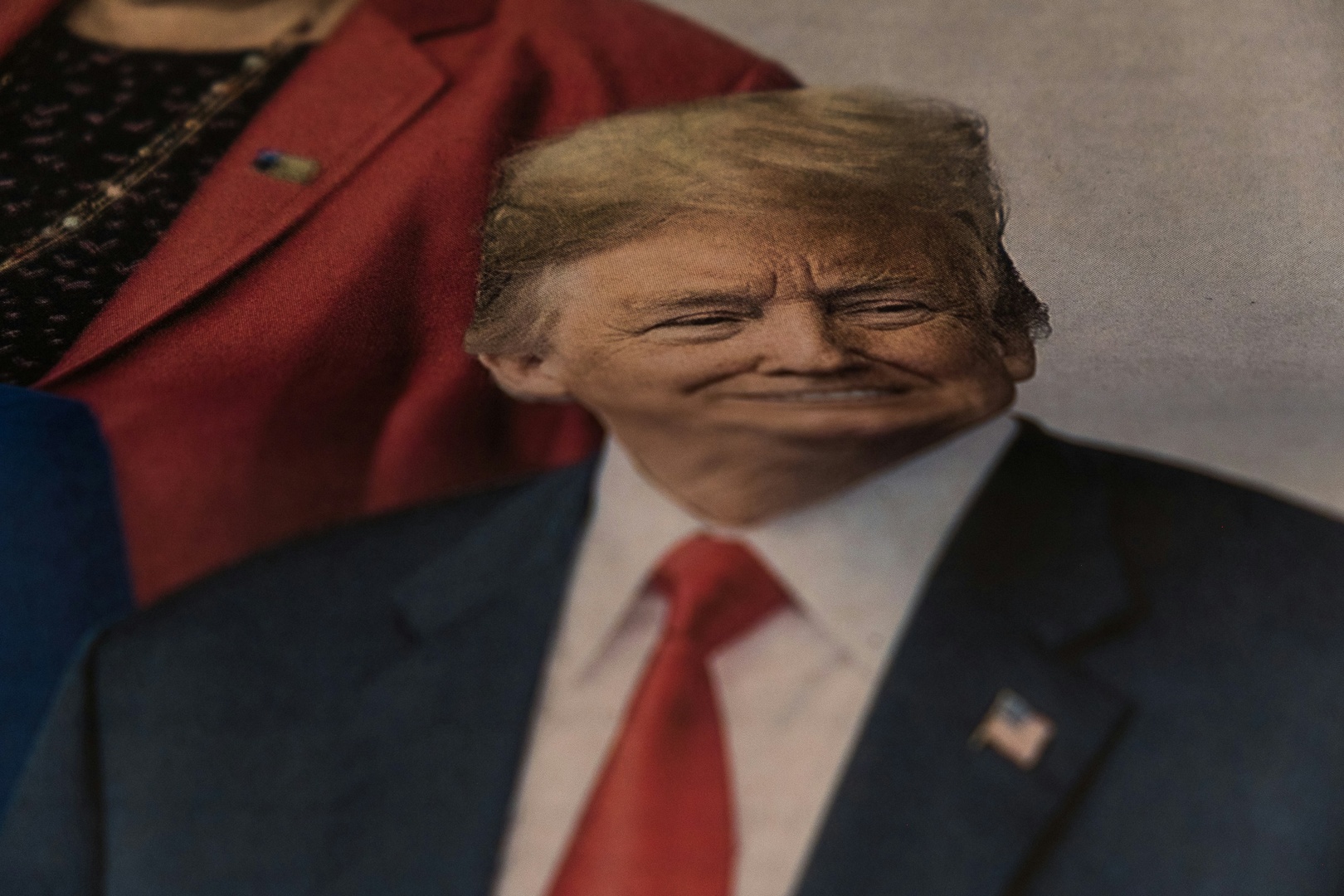

The recent announcement regarding the Trump administration’s AI chip policy reversal marks a pivotal moment in the global technology race, particularly in the realm of artificial intelligence. With preparations to dismantle the intricate three-tier regulatory framework established by the Biden administration, the shift is poised to redefine how advanced computing technologies flow across international borders. This change, slated for implementation on May 15, 2025, reflects a fundamental divergence in policy that could reshape geopolitical dynamics and commercial landscapes alike.

The Biden administration’s Framework for Artificial Intelligence Diffusion was designed to create a stratified global technology ecosystem that would regulate access to advanced AI chips based on a nation’s alignment with U.S. interests and security concerns. However, the Trump administration argues that the existing framework is not only overly complex but also a barrier to American innovation. A Commerce Department spokeswoman articulated this sentiment, stating, \”We will be replacing it with a much simpler rule that frees American innovation and ensures American AI dominance.\” This statement encapsulates the administration’s aggressive stance on fostering U.S. competitiveness in the global AI market while balancing national security considerations.

Understanding the Three-Tier System

To comprehend the implications of the policy reversal, one must first understand the structure of the soon-to-be-eliminated Biden rule. This framework established a hierarchical system for global technology access, categorized into three distinct tiers. The first tier included 17 countries plus Taiwan, which would have had unrestricted access to advanced AI chips. The second tier encompassed approximately 120 nations operating under strict numerical caps on their imports. Finally, the third tier, consisting of nations such as China, Russia, Iran, and North Korea, faced complete exclusion from accessing these technologies.

This structured approach aimed to mitigate the risk of advanced technologies reaching adversarial nations through intermediaries while simultaneously granting access to allies and neutral countries. Critics, however, contended that the complexity of this system would impose significant compliance burdens on businesses and could inadvertently drive international partners toward alternative suppliers. By eliminating this hierarchy, the Trump administration’s new policy promises greater flexibility and a streamlined approach to technology access.

The New Approach Taking Shape

As the Trump administration moves to reshape the landscape of AI chip distribution, reports indicate a departure from the tiered system in favor of a global licensing regime bolstered by inter-governmental agreements. This strategy could allow for enhanced oversight of sensitive technology transfer while still accommodating the commercial interests of allied nations. The timing of this policy shift appears strategically significant, particularly as President Trump prepares for a trip to the Middle East, where nations like Saudi Arabia and the United Arab Emirates have voiced frustrations over existing chip export restrictions.

The Commerce Department is expected to formalize this decision soon, with reports suggesting an announcement could come as early as Thursday. This new direction could open doors for countries that previously faced stringent restrictions, enabling them to negotiate more favorable terms for acquiring advanced AI chips.

Market Reaction and Industry Impact

The announcement of the Trump administration’s policy reversal has already begun to reverberate through financial markets. Following the news, shares of Nvidia, the leading manufacturer of chips utilized for training AI models, experienced a 3% increase on May 7, although they later dipped 0.7% in after-hours trading. Nvidia has long opposed the escalating restrictions imposed by U.S. regulations. CEO Jensen Huang has expressed the belief that American companies should maintain the ability to sell into China, which he anticipates will become a $50 billion market for AI chips in the coming years.

However, it is crucial to note that the Trump administration’s shift does not imply a complete abandonment of export controls. The administration has already taken decisive action against China, exemplified by banning Nvidia from selling its H20 chip in the region, a move that resulted in $5.5 billion in writedowns for the company. This dual approach suggests that while seeking to enhance U.S. competitiveness, the administration will remain vigilant in guarding against potential threats posed by foreign adversaries.

Global Winners and Losers

The implications of the policy reversal extend beyond U.S. borders, creating a complex map of potential winners and losers within the global technology landscape. Countries such as India and Malaysia, which had not previously faced chip restrictions before the Biden rule’s introduction in January, stand to benefit from the new flexibility. In particular, Malaysia’s Oracle Corporation may find opportunities for expansion in data center projects that would have otherwise exceeded the limitations imposed by the Biden administration’s distribution rules.

Middle Eastern nations are also poised to gain from this shift. The UAE and Saudi Arabia, both of which have encountered chip export controls since 2023, may now find themselves in a position to negotiate more advantageous terms. Trump’s administration has shown a willingness to ease restrictions for the UAE specifically, with potential announcements regarding a government-to-government AI chip agreement anticipated during his upcoming visit to the region from May 13 to 16. The UAE’s commitment to investing up to $1.4 trillion in U.S. technology and infrastructure over the next decade underscores the high stakes involved in these negotiations as countries strive to establish themselves as emerging AI powerhouses.

Uncertainty Ahead

Despite the optimistic outlook for some nations, the Trump administration’s transition to a new control scheme introduces a layer of uncertainty that could complicate the regulatory landscape for companies like Nvidia. The specifics of the new framework—whether it will emerge as a formal rule or an executive order—remain unclear. While the administration works on this new approach, it has indicated that existing chip export controls will continue to be enforced.

Insider sources suggest that one possible aspect of the new regime might involve imposing controls specifically on countries that have been identified as diverting chips to China, including Malaysia and Thailand. This has created a divide among industry stakeholders, as chip manufacturers have lobbied vehemently against strict export controls, while some AI companies, such as Anthropic, argue for maintaining protections to safeguard U.S. intellectual property and technological advantages.

Balancing Competing Priorities

The Biden administration’s export controls were designed to restrict access to chips critical for cutting-edge AI development, particularly with an eye toward preventing Chinese firms from exploiting indirect routes to access technology. The challenge for the Trump administration lies in crafting a balanced approach that adequately addresses national security concerns while simultaneously promoting U.S. commercial interests. To establish agreements with a diverse array of nations eager to procure advanced AI chips, the administration will need to navigate complex diplomatic relationships and potentially create numerous individualized policy frameworks.

The Commerce Department has not supplied a specific timeline for the finalization or implementation of new rules, indicating that discussions remain ongoing regarding the optimal path forward. The current shift in AI chip policy reflects the administration’s broader commitment to enhancing American competitiveness and innovation while still exercising control over technologies with significant national security implications. As officials work to develop a replacement framework, the global AI chip market remains in flux, presenting profound implications for technological advancement, international relations, and corporate strategies in the rapidly evolving artificial intelligence landscape.

Key Takeaways

- The Trump administration’s AI chip policy reversal signals a significant shift in U.S. technology export strategy.

- The dismantling of the Biden administration’s three-tier regulatory framework aims to enhance American innovation and competitiveness.

- A new global licensing regime may offer more flexibility while maintaining control over sensitive technologies.

- Countries like India and Malaysia stand to benefit from the policy shift, along with Middle Eastern nations seeking favorable terms for AI chip acquisition.

- Uncertainty remains regarding the implementation of the new regulatory framework and its future impact on the global tech landscape.

FAQ

- What is the Trump AI chip policy reversal? The policy reversal involves scrapping the Biden administration’s three-tier regulatory framework for AI chip exports, aiming to simplify access and enhance U.S. innovation.

- When will the new policy take effect? The new policy is set to take effect on May 15, 2025.