In a bold move that could redefine the landscape of global technology trade, the Trump administration announced this week its intention to overhaul the AI chip export policy established by the previous Biden administration. This policy reversal signals a significant departure from the complex three-tier regulatory framework that aimed to control the flow of advanced computing technologies to sensitive markets. Set to take effect on May 15, 2025, the Biden administration’s Framework for Artificial Intelligence Diffusion would have created a stratified global technology landscape, with profound implications for international trade, innovation, and geopolitical relationships.

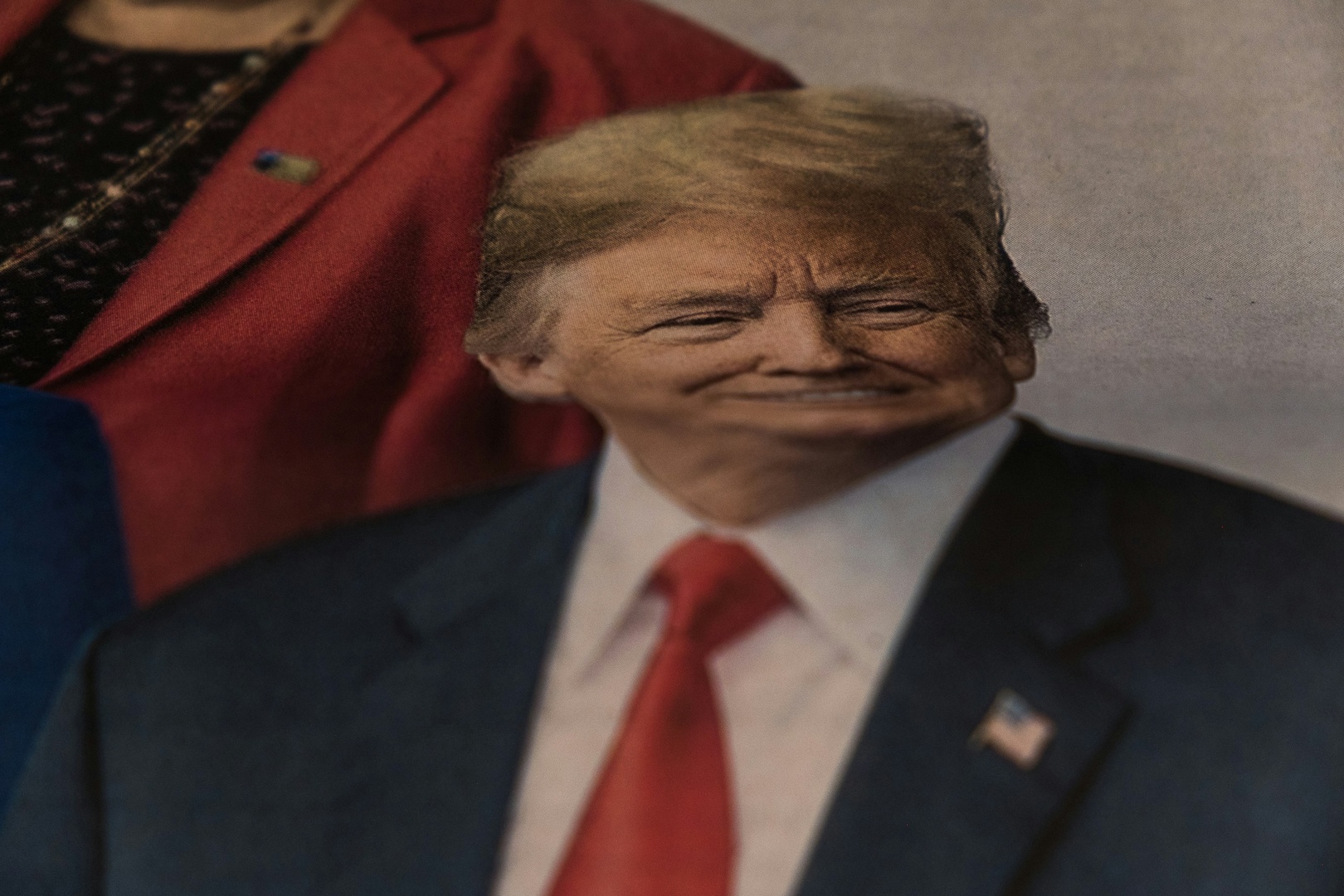

The Biden administration’s approach, culminating in a rigorous structure designed to restrict China’s access to cutting-edge chips while preserving US leadership in artificial intelligence, has now been branded as ‘overly complex’ and ‘bureaucratic’ by the Trump administration. This sentiment was echoed by a Commerce Department spokeswoman, who stated, “The Biden AI rule is fundamentally flawed and would stymie American innovation.” Instead, the Trump administration aims to introduce a simpler framework that promotes American dominance in the AI sector, aligning with its broader strategy of prioritizing American technological superiority.

To understand the implications of this policy shift, one must delve into the intricacies of the soon-to-be-eliminated tiered system. Under this framework, 17 countries, along with Taiwan, would have enjoyed unrestricted access to advanced AI chips, fostering a close-knit alliance among technologically advanced nations. Meanwhile, a second tier comprising approximately 120 countries would have faced strict numerical caps on their imports, creating barriers that could hinder their technological growth. The final tier, which includes nations like China, Russia, Iran, and North Korea, would have been completely barred from accessing these critical technologies. The intent was clear: to prevent sensitive technologies from reaching adversarial nations through intermediaries while still facilitating access for allies and neutral nations. However, critics have pointed out that such a complex system could create substantial compliance burdens and inadvertently drive international partners to seek alternative suppliers, ultimately weakening the US position in the global technology market.

Amidst this backdrop, the Trump administration is reportedly considering a new strategy that would replace the tiered system with a global licensing regime bolstered by inter-governmental agreements. This approach could offer greater flexibility in managing the distribution of sensitive technologies while maintaining vigilant oversight. As President Trump prepares for a trip to the Middle East, where leaders from countries like Saudi Arabia and the United Arab Emirates have expressed their frustrations over existing restrictions, this policy shift takes on an additional layer of significance. Reports indicate that the Commerce Department could announce the details of this new approach as soon as Thursday, potentially reshaping the dynamics of international tech negotiations.

The immediate market reaction to the announcement has been telling. Shares of Nvidia, a dominant player in the AI chip market, surged by 3% following the news, reflecting investor optimism regarding a more favorable regulatory environment. However, this increase was tempered by a 0.7% dip in after-hours trading, indicative of the uncertainty surrounding the future of chip exports. Nvidia’s CEO, Jensen Huang, has been a vocal advocate for unrestricted access to markets like China, which he anticipates will evolve into a $50 billion market for AI chips in the coming years. Nevertheless, it is crucial to recognize that the Trump administration’s policy reversal does not equate to a complete abandonment of export controls. The administration has already demonstrated its willingness to take decisive action against China, exemplified by the ban on Nvidia’s H20 chip sales to the country, which resulted in significant financial repercussions for the company.

As the landscape of global technology trade shifts, various countries will emerge as potential winners and losers. Nations such as India and Malaysia, which had faced chip restrictions under the Biden administration, are likely to experience temporary relief. In particular, Malaysia stands to benefit from Oracle Corporation’s plans for a massive data center expansion that would have been curtailed under the previous regulations. Furthermore, Middle Eastern countries like the UAE and Saudi Arabia are poised to negotiate more favorable terms for AI chip acquisitions, aligning with Trump’s expressed interest in easing restrictions specifically for the UAE. This interest underscores the high stakes involved for nations eager to establish themselves as powerhouses in the AI sector, especially given the UAE’s ambitious pledge to invest up to $1.4 trillion in US technology and infrastructure over the next decade.

Looking ahead, uncertainty looms as the Trump administration develops a new control scheme, which could take the form of either a new regulatory rule or an executive order. This transition phase creates a challenging environment for companies like Nvidia, which must navigate an evolving regulatory landscape. While the new framework is being crafted, the administration has indicated that existing chip export controls will remain in effect, leaving industry stakeholders in a state of flux. There are indications that the new regulations might particularly target countries that have diverted chips to China, including Malaysia and Thailand, highlighting the complexities of the geopolitical landscape.

The divide among industry stakeholders is evident, with chip manufacturers advocating for looser export controls while some AI companies, like Anthropic, argue for the necessity of protections that safeguard US intellectual property and maintain technological advantages. This ongoing debate reflects the broader challenge of balancing competing priorities: addressing national security concerns while fostering commercial interests.

The Biden administration’s export controls were crafted to limit access to chips essential for cutting-edge AI development, particularly aimed at curtailing Chinese firms’ ability to exploit indirect routes to acquire technology. However, the Trump administration’s shift towards a more flexible approach raises questions about how to establish agreements with diverse countries eager to procure advanced AI chips. Navigating this intricate web of diplomatic relationships could lead to the creation of numerous policy frameworks, each tailored to the specific needs and concerns of the involved nations.

As discussions continue, the Commerce Department has yet to provide a definitive timeline for finalizing or implementing any new rules, leaving the industry in suspense. The evolution of the Trump AI chip policy reflects a broader emphasis on American competitiveness and innovation, coupled with a commitment to maintaining oversight of technologies with national security implications. In this dynamic environment, the global AI chip market remains in a state of flux, with significant implications for technological development, international relations, and corporate strategies as the world continues to navigate the rapidly evolving landscape of artificial intelligence.

In the context of this shifting paradigm, industry leaders are left contemplating the future of AI and big data. Events such as the upcoming AI & Big Data Expo in Amsterdam, California, and London provide opportunities for stakeholders to engage with trends and innovations shaping the technological landscape. As participants gather to explore the confluence of AI, big data, and emerging technologies, the implications of these policy shifts will undoubtedly be at the forefront of discussions among industry experts and thought leaders striving to navigate the complexities of the new geopolitical tech landscape.